USDA Mortgage Conditions

An excellent USDA financial in the USDA loan program, also known as this new USDA Rural Invention Guaranteed Houses Loan System, is actually a mortgage loan open to outlying residents from the Us Department regarding Agriculture.

Particular USDA Finance

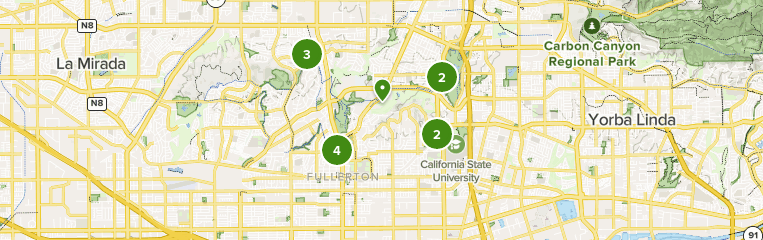

Family members should be instead of sufficient homes, however, have the ability to afford the mortgage repayments, also taxes and insurance coverage. At exactly the same time, individuals need to have reasonable credit histories. At exactly the same time, the home have to be receive in the USDA RD Mortgage footprint. The fresh USDA Home loan maps are currently booked to be changed towards the . USDA Financing give 100% investment in order to qualified consumers, and invite for all closing costs become both covered of the merchant otherwise funded for the mortgage.

USDA Home loans keeps Maximum Family Income Constraints and that differ of the the newest State you purchase a home during the. The cash Constraints transform annual alter, next changes is scheduled to possess . Maximum Household Earnings Limits are based upon everyone in the household who’s a salary earner, regardless if their money is not going to be employed to be eligible for the fresh new USDA Financing. As an instance, Societal Shelter Money of a senior cousin living in the house, was noticed whenever determining the most house money although that cousin was not probably apply to become on home mortgage. You’ll find write-offs however, one USDA Underwriters allow it to be, and oftentimes, the individuals data tend to eliminate a family group in Limitation Household Income Restriction.

Any State property agencies; Lenders approved by: HUD to own distribution off programs to own Government Casing Home loan Insurance rates or given that an issuer from Ginnie Mae home loan backed bonds; the fresh new You.S. Pros Government since the a qualified mortgagee; Fannie mae having contribution in the loved ones mortgages; Freddie Mac computer to possess participation in the family unit members mortgage loans; One FCS (Farm Credit System) organization having direct financing power; One financial doing almost every other USDA Outlying Invention and you may/otherwise Ranch Solution Agency protected mortgage applications.

Financial Insurance rates: USDA Money require 2% of price into the beforehand financing fee, and you will a monthly home loan premium considering .40% out of harmony a-year. The fresh annual advanced is actually separated by several to get to this new superior fees monthly.

Direct Mortgage

Purpose: Part 502 money are primarily always help low-earnings somebody or houses buy house within the outlying parts. Money can be used to build, resolve, renovate or move around in a home, or even to get and prepare internet, and additionally delivering liquid and you may sewage business.

Eligibility: Individuals getting direct funds regarding HCFP should have suprisingly low or lower revenues. Really low income means less than 50 % of city average income (AMI); lower income is between 50 and you may 80 per cent from AMI; average earnings try 80 to completely of AMI. Click on this link to examine city income restrictions because of it program. Family need to be instead sufficient construction, however, have the ability to afford the mortgage repayments, including taxes and you may insurance rates, which can be generally 24 percent from an enthusiastic applicant’s income. Yet not, fee subsidy can be acquired so you’re able to individuals to compliment cost function. People must be incapable of see credit somewhere else, but really enjoys reasonable credit records.

Rural Fix and you can Rehabilitation Financing

Purpose: The Reduced-Income Construction Repair system brings funds and features to help you really low-earnings people to fix, improve, or modernize its homes or to dump safety and health risks.

Eligibility: To get financing, homeowner-residents should be unable to see reasonable borrowing from the bank in other places and may have quite lowest income, identified as less than fifty percent of your area median money. They should want to make repairs and you can developments to make the house more safe and hygienic or perhaps to clean out health and safety problems. Grants are just accessible to people that 62 years old otherwise more mature and cannot pay off a part 504 loan.

USDA financial compared to conventional mortgage

step one. USDA financing need no advance payment, you’ll be able to loans to 100% of the property worthy of. dos. You ought to meet up with the money constraints on Condition you are searching for. For every single state enjoys a maximum Income Requirements. Brand new USDA Mortgage step three. System does allow for factors for costs for example Child care. cuatro. Become qualified, you should be purchasing a home into the an outlying area since discussed because of the USDA. 5. Your house otherwise property your looking to buy have to getting manager-occupied, money characteristics aren’t qualified to receive USDA fund.